Every four years we as citizens of America march to the ballot box to elect our next president. It’s arguably the greatest civil duty we possess as everyday Americans. Had our founding fathers known the wonderful personalities that the democratic process could create, however, I think they might have realized King George III wasn’t so bad after all.

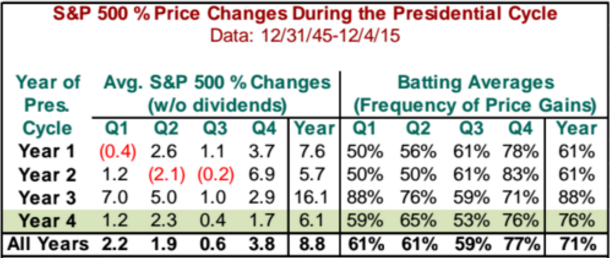

In all seriousness, presidential elections create an air of uncertainty that extends throughout our society; financial markets are by no means immune to this effect. They dominate our attention for months on end and many of us worry about what might happen to our world if the nation elects the other candidate. Sam Stovall, U.S. Equity strategist at S&P Capital IQ, charted the annual returns of the S&P 500 according to the years of a president’s term to find out how markets respond to presidential election cycles.1 He found that year 2 of a presidency tends to have the weakest average return and year 3 tends to have the strongest return. Election years, year 4, average 6.1% annual return which is below the S&P 500’s annual average return of 8.8%.2 However, election years tend to have positive return 76% of the time, while the S&P 500 on average is positive 71% of the time. It’s important to point out that Stovall intentionally didn’t omit any years in these averages. 2008, our third largest annual loss in history, was an election year. If 2008 was omitted, the average for election years would be much higher. It might be surprising that election years tend to be positive more frequently than the average, but it’s a good reminder that outside the slog of the campaign trail the world keeps turning. Even this year, when you might think the sky is about to fall after turning on the news, has brought strong return on the S&P 500 which is currently up 4.6% year to date.3

It might be surprising that election years tend to be positive more frequently than the average, but it’s a good reminder that outside the slog of the campaign trail the world keeps turning. Even this year, when you might think the sky is about to fall after turning on the news, has brought strong return on the S&P 500 which is currently up 4.6% year to date.3

We all want to be market timers and find a way to outsmart the market but what we should really be doing is focusing on our long-term strategies and disciplines. It’s nearly impossible to predict the daily news that will affect the daily changes in the market. One piece of news saying a candidate did this or that can hold news coverage for a few days and in turn can affect markets. But with many things in the 21st century, our attention spans are short and news cycles are even shorter. We believe it’s best to wait for things to blow over while holding to your disciplines rather than worry about what might happen on a daily basis.

Don’t forget to vote on November 8th!

1: http://www.marketwatch.com/story/2016-predictions-what-presidential-election-years-mean-for-stocks-2015-12-29

2: Averages exclude dividends

3: As of market close on 10/14/2016

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Investing involves risk including loss of principal.