What the SECURE 2.0 Act Means for You and Your Retirement The Senate passed the SECURE 2.0 Act on Thursday, December 12th. The bill now goes to the House of Representatives for their vote. Assuming the House passes the bill, it then goes to President Biden, who signs it into law. We

IRONMAN Madison WI

I don’t know what you were doing on Sunday, but, like me, you probably weren’t running a full 26.2 mile marathon AFTER biking 112 miles AFTER swimming 2.4 miles in open water. And, you probably didn’t do this in 55 degree temps with 20 mph winds and never-ending pouring rain. But this is exactly

Student Loan Forgiveness

Student Loan Forgiveness We finally got some answers on Wednesday to the long-standing question of whether or not the Biden administration would provide some sort of federal student loan forgiveness. The answer is yes – for most borrowers, anyway. We’ll get more details over the weeks to

2021 Year-End Recap

https://vimeo.com/672370493 Tad Weiss, CFP®, President of Modus Advisors, talks with our own Kari Haanstad to provide a 2021 year-end recap. Kari is our Chief Investment Advisor and resident Chartered Financial Analyst (CFA®). STOCK MARKET While 2021 was a relatively calm year for the

New Year, New Contribution Limits

Happy New Year! A new year brings with it new limits for contributions and savings. Many of the figures this year are updated. This article highlights the federal contribution limits of which to be aware as you enter this new year. Qualified Plans: For qualified plans, such as 401(k)s

A Minute with Modus – What the Economic Rebound Means for Your Portfolio

A Minute with Modus - What the Economic Rebound Means for Your Portfolio Kari Haanstad, CFA®, discusses the "medicine" of fiscal and monetary stimulus and what the economic rebound means for your investment portfolio. Last year, many people were dealing with COVID-19. Our economy was also sick.

A Minute with Modus – Growth vs. Value in Today’s Market

A Minute with Modus - Growth vs. Value in Today's Market Kari Haanstad, CFA, explains that we are seeing a shift in leadership in the markets. Now is a great time to assess your portfolio to ensure you have enough exposure to the types of equities that thrive in the current market conditions. We

1Q 2021 Commentary

1Q21 Update Market Update What a difference a year makes! It’s hard to believe that, exactly one year from its low on March 23, 2020, the S&P 500 was up a staggering 81%. Over the course of the past 12 months, we’ve gone from virus to vaccine. From

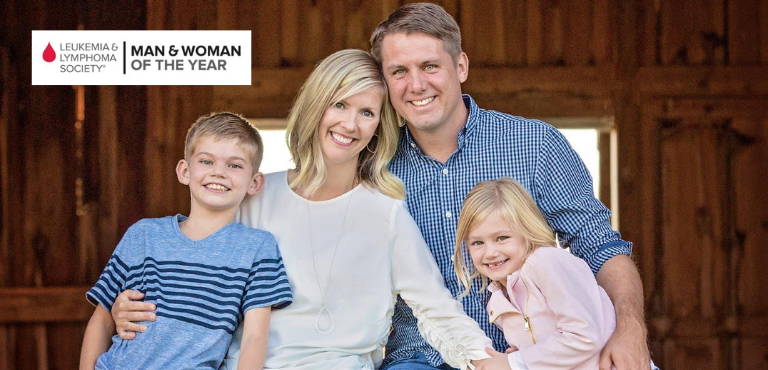

Q1 2021: Leukemia & Lymphoma Society

When someone we love goes through something we just cannot fix, the sentiment always seems to be “I just wish there were something I could do.” A few years ago, I watched helplessly as my dear friend Heidi Gusenius endured a fight against AML, a type of Leukemia. In fact, this was her second